Homeowners Insurance in and around Hickory

Homeowners of Hickory, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

You have plenty of options when it comes to choosing a home insurance provider in Hickory. Sorting through providers and deductibles isn’t easy. But if you want competitive priced homeowners insurance, choose State Farm. Your friends and neighbors in Hickory enjoy incredible value and no-nonsense service by working with State Farm Agent Juliet Good. That’s because Juliet Good can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as linens, swing sets, furniture, sound equipment, and more!

Homeowners of Hickory, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Open The Door To The Right Homeowners Insurance For You

That’s why your friends and neighbors in Hickory turn to State Farm Agent Juliet Good. Juliet Good can outline your liabilities and help you find the most appropriate coverage for you.

So get in touch with agent Juliet Good's team for more information on State Farm's terrific options for protecting your home and keepsakes.

Have More Questions About Homeowners Insurance?

Call Juliet at (828) 345-0740 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

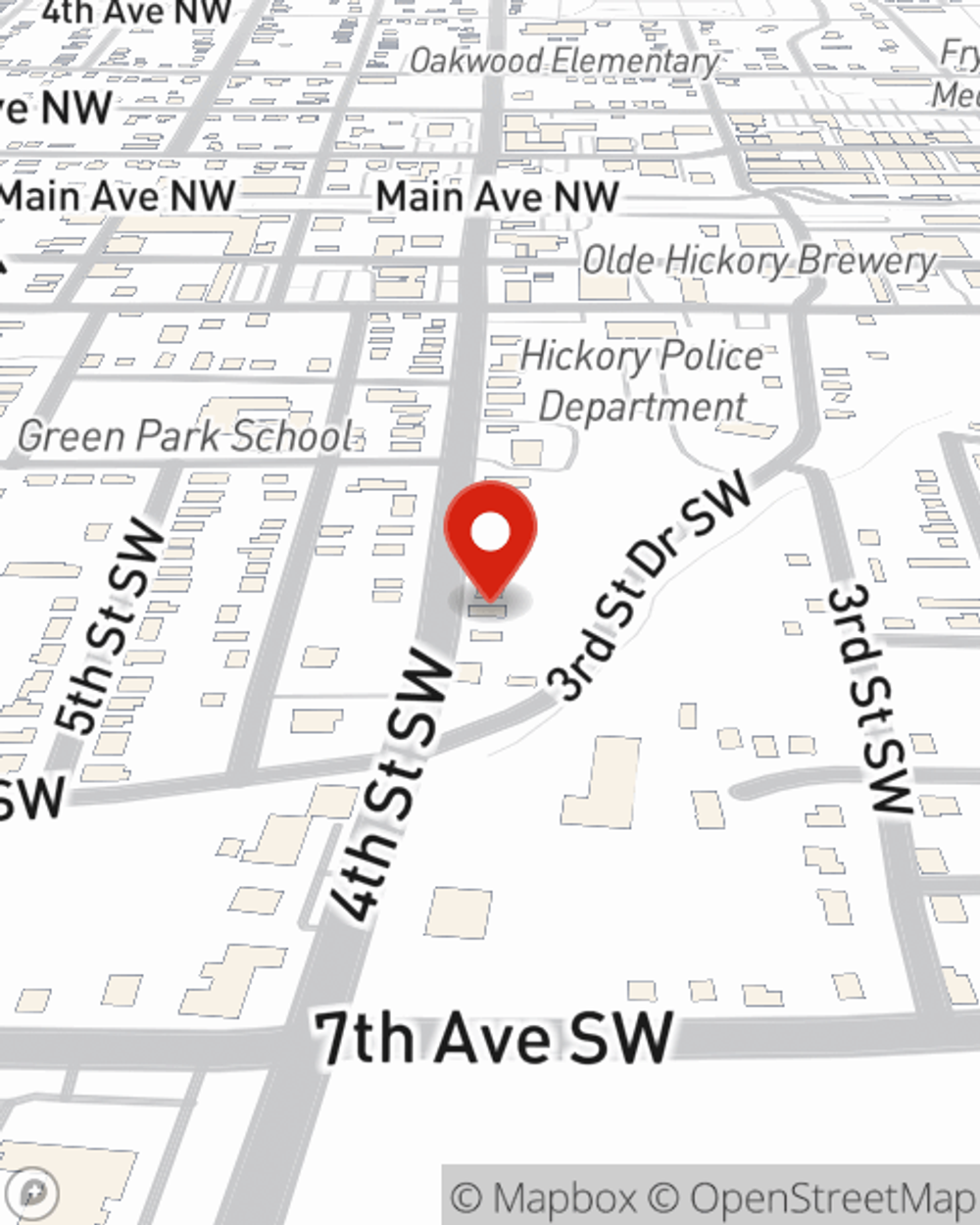

Juliet Good

State Farm® Insurance AgentSimple Insights®

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.